Retirement benefit given to retired employees

Superannuation = 15% of last drawn basic + DA (Annual Basic)

| No. of Years worked | % |

| < 1 year | NIL |

| 1 – 2 Years | 50 |

| 2 – 3 Years | 75 |

| 3 Years & > | 100 |

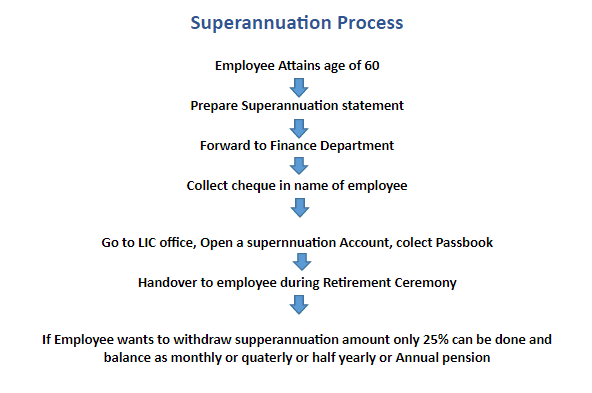

Superannuation Process

Once the employee attains the age of 60 based on the management approval, we will prepare the superannuation statement and will forward the same to finance department. We will collect the cheque in the name of employee.

After that we will go to LIC (Life Insurance Corporation of India) office, we would need to open a superannuation account on the name of employee. We will deposit the cheque into the account. We will collect passbook & will handover the same to employee during retirement ceremony.

If the employee wants to withdraw superannuation amount, they can withdraw only 25% and balance amount employee will get it as monthly or quarterly or half yearly or annual pension based on the mode of payment selected.