EPF Employees Provident Fund Act 1952

Organisation which has Employees more than 20 has to register with EPF

Registration should be done by company with EPFO, now the registration has been made ease friendly that online registration has been allowed.

Where do we go to get registration for Employee Provident Fund for a Company?

We have a specified website which has been provided by Government & the website is known as Unified Shrum Suvidha Portal (USSP)

To get the Employee Provident Fund Registered for the Company we would also require to get Labour Identification Number, which is registration for a Company, in short it has been called as LIN Registration.

Let’s discuss on the documents required for LIN – Labour Identification Number Registration

- COI-Certificate Of Incorporation

- PAN-Permanent Account Number Card

- Shops & Establishment Certificate

- Rental or Lease Agreement Copy

- PAN-Permanent Account Number Card and Aadhaar copy of Owner

- Digital Signature/Authorization copy

- Employee Register-Form 9 (Covering letter)

- Form 2 Nomination Declaration Form

- Form CDF-11 (Combination of Form 11 & Form 13)

Things to do before Registration

- Prepare PDF documents required for Registration

- Collect DSC – Digital Signature Certificate from Authorized Signatory

- Check with establishment it has LIN registration or not (Labour Identification Number)

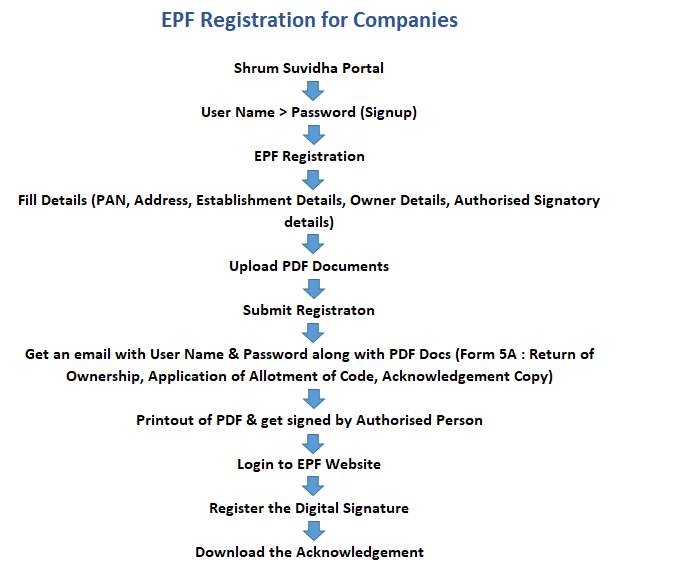

Registration Process

If your registration is through online, we will go to Shrum Suvidha Portal ( USSP), we sign up with the Owner Registration. After that we will login to Shrum Suvidha portal with Username & Password. We will initiate PF Registration. (When the count of employee reaches 20 or whenever the establishment requires to have the Registration).

We will update all necessary details such as Establishment Details, PAN Number, Address, Owner Details, Authorized Signatory Details etc. We shall upload the PDF document & will submit the registration in Shrum Suvidha Portal.

Once the registration is approved by EPFO, we will get an email with the establishment Username and Password. Password provided on the mail would be a temporary password along with the PDF attachments.

What are the documents provided by EPFO on Registration Confirmation mail ?

- Form “5-A” Return of Ownership after online application for Code

- Application for allotment of Code

- Acknowledgement copy application submitted online for allotment of Registration Number

Take printout of all above specified PDF files, get the documents signed by the Authorized Person. Login to “Establishment sign in” on EPFO website, register the Digital Signature of Authorized Person & download Acknowledgement. Take a printout of the acknowledgement on LetterHead of your Company get that signed by Authorized Person.

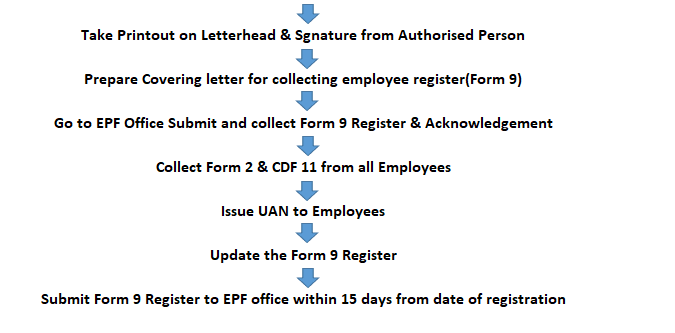

Along with the above documents prepare a Covering letter for collecting “Employee Register” Form-9. Take photo copy of all documents and split it as 2 sets. Go to PF Office nearby & submit both the sets of document. Collect the Form 9 Register & Acknowledgement copy of the documents what you have submitted with the Acknowledgement Seal on it.

Documents to be submitted

- Form 5-A Return Of Ownership

- Code Development Letter

- Acknowledgement of Online Application

- Digital Signature on Letterhead of Company

- Covering Letter for Form-9 Register

After collecting Form 9 Register, we will collect Form 2 (Nomination Declaration Form) from Employees and CDF 11 (Composite Declaration Form 11), which is a combination of Form 11 (Declaration of UAN) and Form 13 (Transfer of PF) from all employees and we will issue UAN (Universal Account Number) to all Employees. We will update the details in Form 9 Register. We will get the Member ID (Employee PF Number) which is required for the Form 9 Register from the UAN Registration copy.

We have to submit Form 9 Register to EPF office within 15 days from the date of Online Registration.

| Establishment code | PYBOM1462125000 | ||

| State code | Branch code | Establishment Code | Extension |

| PY | BOM | 1462125 | 000 |

EPF Branch Offices in Bangalore

| BOM | Bommasandra which is in Singa Sandra |

| KRP | K R Puram |

| PNY | Peenya Industrial Area |

| BNG | Richmond Road |

| MYS | Mysore Road |

2014 : started with UAN number and before that Member id has been playing its role, Universal Account Number will consist of 12 digit.

What is the procedure for UAN Registration for Employees / How to issue UAN number to Employee?

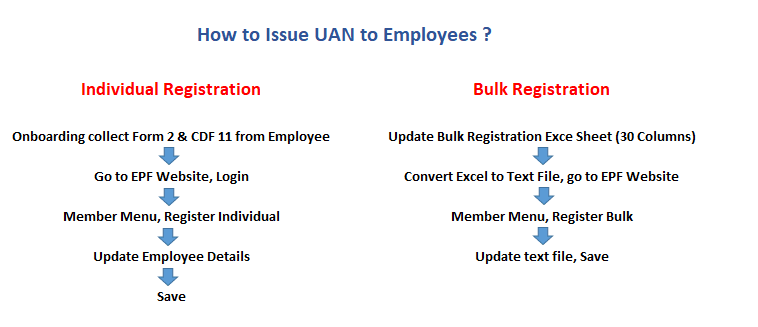

Employee UAN can be issued individually or as a Bulk.

Individual Registration of Employee for UAN

At the time of On-Boarding of an Employee, we will collect Form 2 & CDF 11 filled by Employee. Whether they are a fresher or experienced or already covered under EPF in the previous company still we take these forms during On-Boarding . If it is an Individual Registration, we will go to EPF website and Login with our Establishment Username and Password. Under “Member Menu” we will click on “Register Individual” and update the Employee details as per the Aadhaar card. Also we will update the KYC details such as PAN card, Bank Account and Aadhaar is mandatory and click on “Save“.

Note : Both Aaadhaar card and PAN card name should match, so please verify the documents before uploading.

Bulk Registration of Employees for UAN

For Bulk Registration process we will update Bank Registration excel sheet, which consist of 30 columns with all employee details and we will convert the file to text file for uploading (Conversion of Excel to Text File). After that we will go to EPF website under “Member Menu” click on “Register Bulk“, we will upload the text file and if any error comes, we will correct the text file and upload it again and we will click on “Submit“.

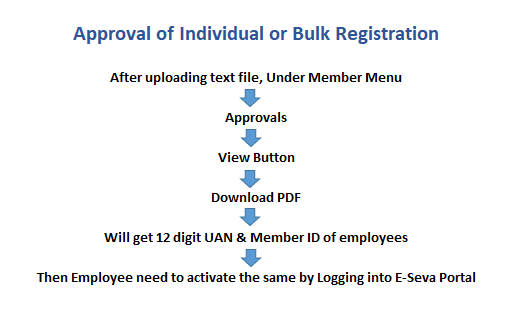

Approval of Individual & Bulk Registration

After completing the Individual or Bulk Registration under “Member Menu” click on “Approvals“, click on “View” button and verify the PDF documents. Click on “Approve” button for approving the PDF file. Download the PDF file and you will find 12 digit UAN number and also Member ID of Employee which has been allocated .

Take printout of UAN PDF and keep the copy n employee file, send a copy of the same to Employee through mail attaching soft copy. Provide employee with the instructions to activate their UAN, EPF website member E Seva. With the help of UAN Employee can view their PF Balance, passbook, their nominee and apply for transfer of PF, also can Withdraw the amount from PF through online mode.

5 DIFFERENT ACCOUNTS OF PROVIDENT FUND

EPF wage Maximum limit is ?15000/-, its is compulsory to have EPF if the salary is less than ?15000/-

Employee Provident Fund Wage = Basic + DA + Special Allowances

| Account Number | Share Owner | Percentage | Example |

| Account 1 | Employee Share | = 12% on EPF Wage | ?1800 |

| Account 10 | Employer Share | = 8.33 % on EPF Wage (Max ?15000) | ?1250 |

| Account 1 | Employer Share | = Employee EPF Share – Employer EPF Share contribution to Account 10 | ?550 (1800-1250) |

| Account 2 | Administration Charges by Employer | = 0.50% on EPF Wage (Minimum of ?500) | ?500 |

| Account 21 | Deposit Linked Insurance (EDLI) 1976 by Employer [In case of death of Member, Nominee will get ?6,00,000 insurance amount] | = 0.50% on EDLI Wage (Max EDLI Wage is ?15000/-) | ?75 |

| Account 22 | EDLP Administration Charges by Employer | = 0 on EDLI Wage | ?0 |

Total Employee Provident Fund Contribution

| Total Employee Share | 12% |

| Total Employer Share | 13% |

| Total PF Contribution to PF Fund | 25% |

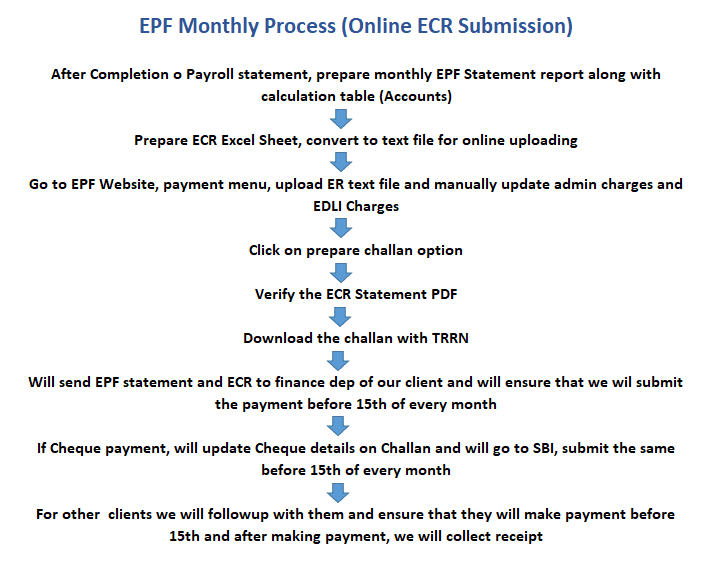

Employee Provident Fund Monthly Process, Online ECR Submission

After completion of Payroll Statement for each client we will prepare “Monthly EPF Statement Report” along with calculation table of accounts shown above. After that we will prepare “ECR Excel Sheet” and convert the same to text file for online uploading (Conversion of Excel to Text file). We will go to EPF website, under “Payment Menu” we will upload ECR text file and we will manually update the administration charges and EDLI charges. We shall then click on “Prepare Challan” option and we will verify the ECR statement PDF and download the challan with TRRN – Temporary Returns Reference Number.

We will send the EPF statement, ECR PDF statement and Challan PDF to Finance Department of our client and we will ensure that they will submit the payment before 15th of every Month.

If the client is giving us the cheque payment, we will update the check details on Challan and we will go to SBI to submit the same. We will carry two sets and before 15th we will have this submitted every month, for other clients we will follow up with them and ensure that we will make the payment before 15th and after making payment we will collect the receipt copy and file the same.

Provident Fund Transfer Process

At the time of On-boarding of an Employee, if the Employee wishes to transfer PF from his previous company to present company, we will collect CDF 11 and will instruct the Employee to initiate the transfer process after 30 days from the UAN login account.

Instruct the employee to submit online transfer acknowledgement form 13 to HR Department.

Once the Employee submits Form 13, we will go to EPF website, under “Establishment login” go to “Online Services” menu and “Approve” the transfer initiated by Employee with the help of the Digital Signature.

How to Withdraw PF ?

With effect from 1 February 2019, withdrawal of PF is made online for Employees. Employee can withdraw PF only if they are not employed for more than 60 days from the date of leaving and employee can withdraw 75% if they are not employed for 45 days.

Employees have to initiate the withdrawal process under “Online Services” menu after online submission, Employee must submit hard copy and Form 15 G within 7 days to PF office else the withdrawal claim will be cancelled. Now that even Form 15 G has been provided on the Online website on EPFO and can be filled in easily.

ECR : Electronic Challan Return

| Dated | Details |

| 1 Sep 2014 | EFP Wage has beeb increased from ?6500 to ?15000 |

| 1 Sep 2014 | Minimum monthly pension contribution by an employer has bee increased from ?542 to ?1250 |

| 1 Sep 2014 | If an employee enrolled under EPF after 1 Sep 2014 for the first time coverage and if the employees EPF Wage is more than ?15000 then the employee does not have to contribute towards EPS |

| 1 Sep 2014 | Minimum Pension received by an employees after the age of 58 has bee increased to ?1000 per month |

| 1 April 2019 | Monthly Pension received by an employer after the age of 58 has been raised as per Supreme Court Verdict. Monthly Pension = Number of Years service * Last drawn EPF Wage/70 |

| 1 Jan 2015 | Administration Charges has been decreased from 1.10% to 0.85% |

| 1 April 2016 | Administration Charges has been decreased from 0.85% to 0.65% |

| 1 July 2018 | Administration Charges has been decreased from 0.65% to 0.50% |

| 1 October 2014 | EDLI Insurance cover amount increased from 1.56 Lakh to 3 Lakh |

| 6 June 2016 | EDLI Increase to 3 Lakh to 6 Lakh |

| 1 April 2017 | EDLI Admin Chanrges has been reduced from 0.01 to 0, minimum amount of ?200 reduced to 0 |

| 1 Feb 2019 | EPF Withdrawal initiated by Employee through Online |

| 1 Apr 2019 | Employee EPF Wages should be calculated with Basic + DA + Special Allowance |

What was the old Process of PF withdrawal if employee wished to do so ?

Employee had to submit 4 Forms specified below till dated 2018

- Form 19 : Withdraw Account No. 1

- Form 10 C : Withdraw Account No. 10

- Form 31 : Withdraw Partial Amount

- Form CCF : Composite Claim Form > 2 sets

- Form 15 G : Income Tax Declaration Form

Is there any Tax deduction on EPF Withdrawal ?

If any employee withdrawing his PF within 5 years of service, if the withdrawal amount is more than ?50,000 then the employee must submit PAN Copy and Form 15 G for Tax exemption (TDS) Tax Deducted at Source.

If employee does not submit PAN Card copy, claim will be rejected and if the employee do not have PAN Card, 34.6 % Tax will be deducted on Withdrawal amount. If Form 15 G is not submitted 10% will be deducted on withdrawal amount.

PMRPY : Pradhan Mantri Rozgar Prothsaha Yojana (2018 – 2019)

If any PF enrollment during 01/04/2018 and 31/03/2019, Government has paid 10% of EPF for 3 years to encourage the contribution.

How do I change Authorized Signatory and Digital Signature ?

Whenever there is a change of authorized signatory or the digital signature expiry, we will collect the new Digital signature USB Token and after logging into EPF Website, under “Establishment Menu” click on “DSC-ESIGN”, we will register te DSC and after that we will download the request letter and take print out on letterhead. We will take signature from authorized signatory Person, we will submit the same to PF Office. DSC will activated within 7 days. Once the PF Officials activates the DSC, we can register for E Sign which is linking the Aadhaar Card of the authorized Person.

Employee Exit Process from Provident Fund

Individual Exit

After Logging into EPFO website under “Member Menu” click on “Member Profile” and enter the UAN No. of left employee and click on “Search”. Click on mark “Exit Tab”. Select the exit reason and enter the exit date. Click on “Save”.

Bulk Exit

Go to “Member Menu” click on exit bulk. CESSATION : Absconding, termination. Prepare bulk exit excel sheet. Convert the Excel file to text file for uploading(Conversion of Excel to Text file). Upload the text file and “Submit”.

Go to “Approvals” Tab, view and verify the PDF File. Click on Approve. Download the exit pdf file.