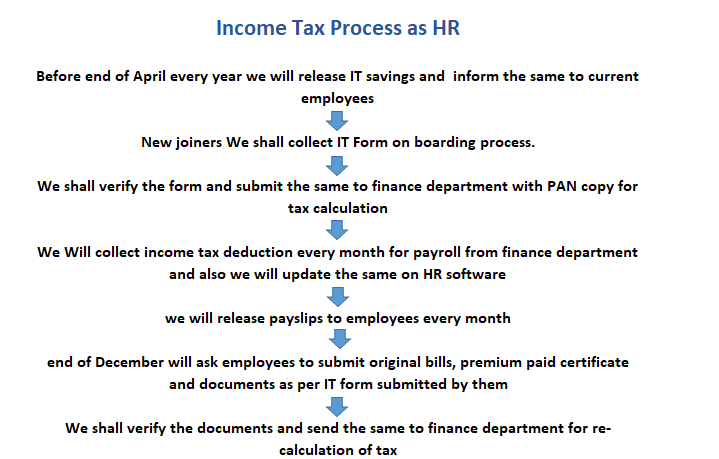

At the time of onboarding of an employee we will collect income tax savings declaration form for tax exemption and for all other current employees we will release this form before end of April every year.

We will verify these forms and will submit the same along with PAN copy to finance department for tax calculation, we will collect the income tax deduction input every month and we will update the same on payroll statement as well as HR software. After that we will release the pay slips to employees every month.

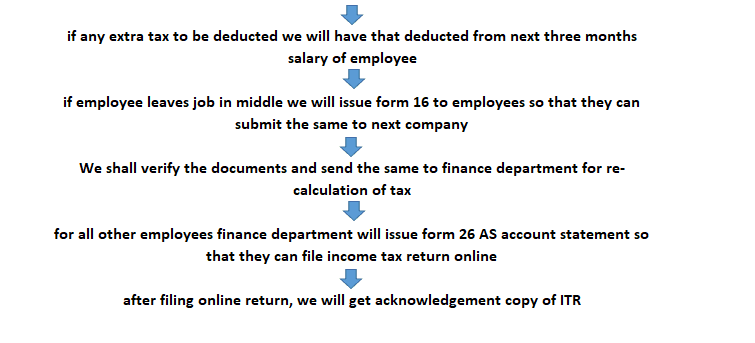

By end of December we will ask employee to submit all the original bills, premium paid certificates and documents as per the income tax declaration form submitted by them. We will verify the bills and documents and we will forward the same to finance department for re-calculation of income tax. If any extra tax to be deducted, will be directed from next three months salary.

If the employee leaves job in middle of financial year, finance department will issue form 16 to employee so that employee can submit the same to the next company, but for all other employees, finance department will issue form 26AS account statement to employees so that they can file income tax returns online.

After filing online written employee will get a ITR acknowledgement ITR, currently no need to submit ITR file physical copy to income tax department since PAN is linked with Aadhaar card.