E-Prerana Website : pt.kar.nic.in

Karnataka Professional Tax Slabs

| Salary Range | Professional Tax |

| ?0 to ?14999 | ?0 |

| ?15000 & above | ?200 |

RC : Registration Certificate

EC : Enrollment Certificate

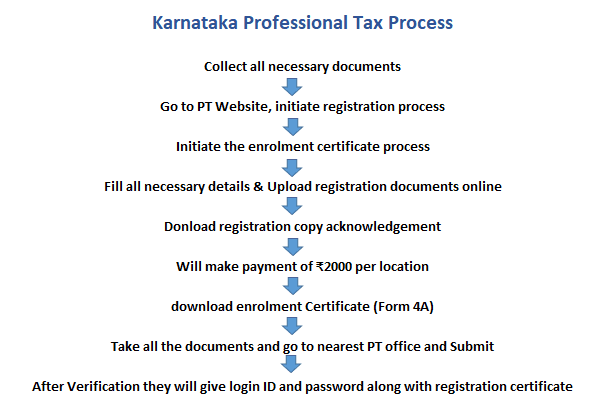

Karnataka Professional Tax Registration Process

We will collect the necessary documents required for registration from our clients.

Documents required for PT registration

- Certificate of Incorporation

- Rental Agreement

- PAN Card

- MOA

- AOA

- LLP

- Aadhaar Card of Director

We will go to PT Website (pt.kar.nic.in) and will initiate the registration certificate process after that we will initiate Enrollment Certificate Process. We will update the necessary details of the Establishment ad we will upload the registration documents online and download the registration copy acknowledgement after that we will make the payment of ?2000 per location and will download the Enrollment Certificate Form 4A.

We will take the printout of registration certificate acknowledgement and enrollment certificate, Form 4A along with the supporting documents. We will go to PT Office located at Yeshwanthpur BMTC dippo.

We will submit the documents to the respective PT Circle Office, after verification they will give login ID and password along with registration certificate for the monthly and annual return process.

Monthly Return Form : Form 5A has to be submitted before 20th of every Month

Annual Return Form : Form 5 has to be submitted before 30th May of every year.

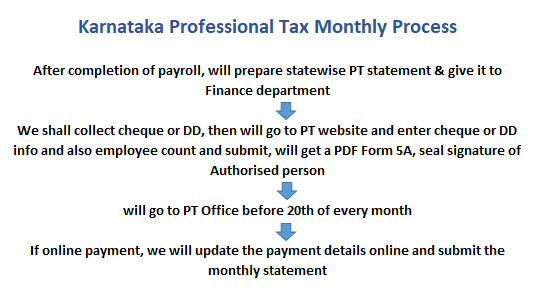

Professional Tax Monthly Process

After completion of Payroll Statement, we will prepare state wise PT Statement report and we will submit the same to finance department of our clients after taking approval from Manager.

We will collect the cheque or DD payment, then we will go to PT Website and we will update the employee count details as per the slabs. We will update the cheque payment details and after submission monthly return 5A Form, PDF will be generated.

We will take printout of same and will put seal & Signature of authorized signatory and along with cheque Payment we will go to PT Office before 20th of every month.

In case of online payment we will update the payment details online & Submit the monthly returns, no need to visit the PT Office.

Penalty & Interest if Payment Delayed

| 1.25% | of Interest will be charged on PT Amount, in case of non submission of payment before 20th of every month |

| ?250 | will be charged in case of non submission of monthly or Annual Returns |

| ?1000 | will be charged in Case of non registration of establishment |