If you withdraw from EPF before completing 5 years of continuous service, TDS will be deducted. However, no TDS will be deducted when amount is less than Rs 50,000/-. What’s the way out to avoid this if you have worked for 5 years but with different organizations (2 years with Company A and 3 years with Company B).

EPFO introduced Universal Account Number(UAN), which acts as an umbrella for the multiple Member ID’s allotted to an individual by different employers.

UAN enables linking of multiple EPF Accounts (Member ID) allotted to a single member.

Let us understand the procedure step by step with help of screenshots:

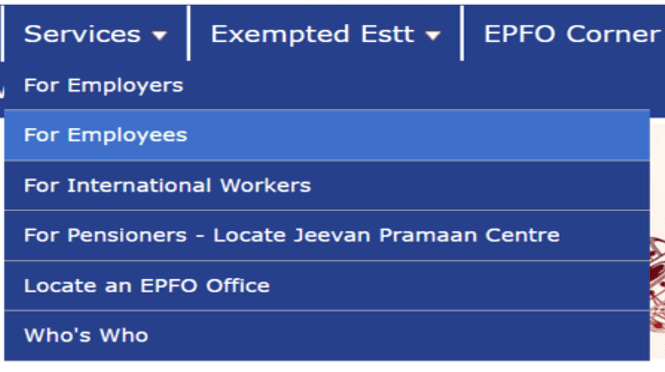

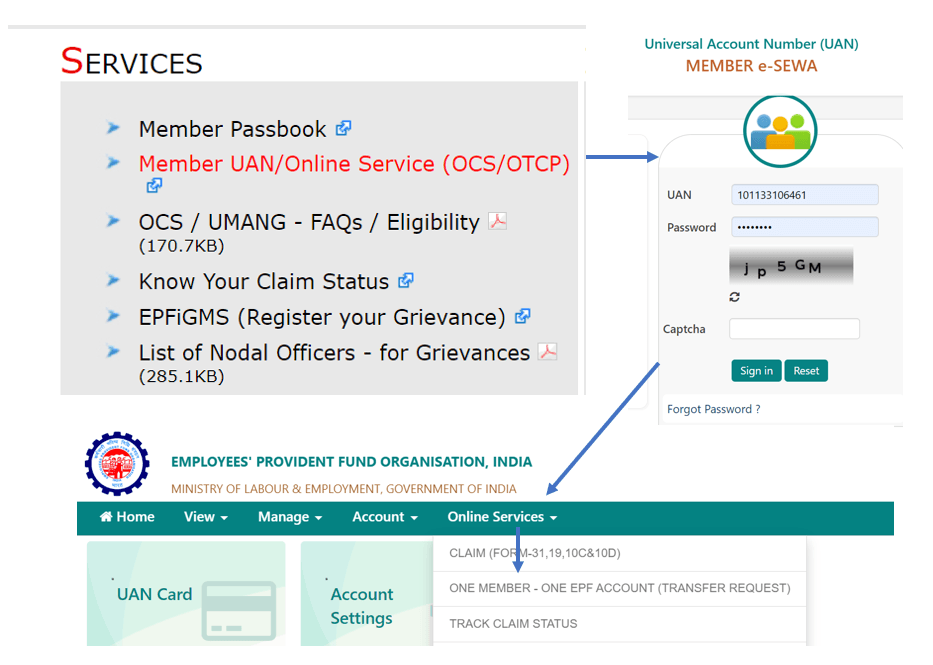

step 1: Login to Unified portal (member interface) by using your credentials i.e, UAN number & Password

Step 2: After Login, click on ‘One Member – One EPF Account (Transfer Request)’ under Online Services

Step 3: Verify personal information & PF account for present employment

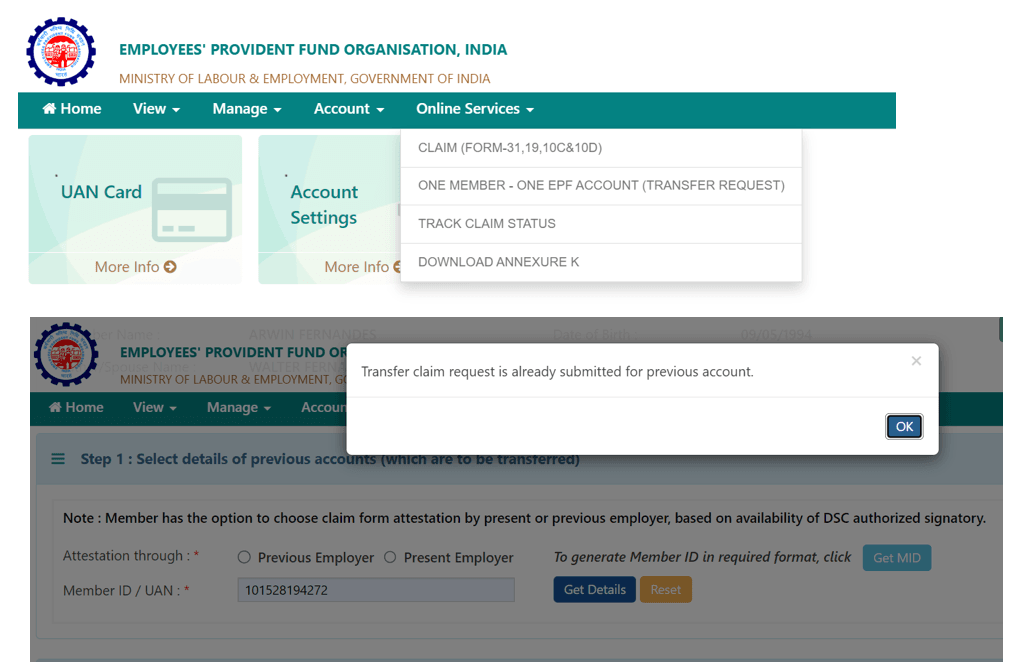

Step 4: PF account details of previous employment would appear on clicking on ‘Get Details” as shown above

Step 5: You have the option of choosing either your previous employer or current employer for attesting the claim form based on the availability of authorized signatory holding DSC (Digital Signature). Choose either of the employers and provide member id/UAN

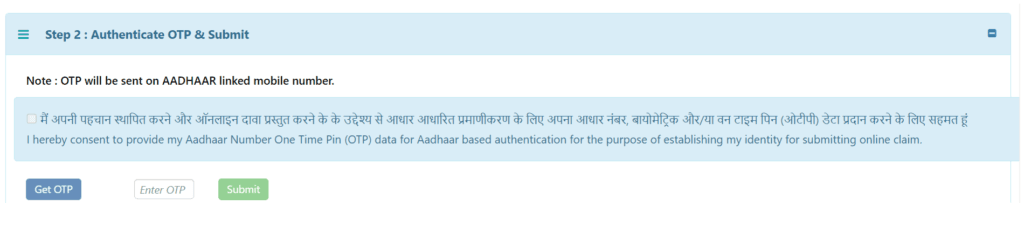

Step 6: In the next step, click on ‘Get OTP’ to receive OTP to UAN registered mobile number and enter the OTP and click on submit

The Employer will Digitally approve your EPF Transfer request by accessing employer interface of the Unified Portal, this has been automated and EPF would send notification to Employer, there wont be any action required from employee stand point to inform concerned.

Fill up Form 13 with details including PF number from both previous Employer and Current employer and download the transfer claim (PDF Format)

Submit the Physical signed copy of the Online PF Transfer claim form to the selected employer within a period of 10 days.

Latest Updates:

Post Step 6 from Employee no further action is required as that has been automated and will be taken care by EPFO on you EPF Transfer, No Physical documents needs to be submitted, its all Online, Employee can fill on the details of Bank at the time of Withdrawal and amount would be transferred directly to account post Bank Account Number Verification.